SoftMetal and arbitrage opportunity

SoftMetal and arbitrage opportunity

What is an arbitrage opportunity? It refers to the simultaneous buying and selling of an asset in different markets to profit from any price differences.

That occurs in many markets, including currencies, stocks and of course commodities, some of the most liquid and transparent markets.

Despite being a widely accepted principle it is very hard to achieve an arbitrage opportunity in the ferroalloys market. While it does appear from time to time, the overall possibility of it is very limited, but SoftMetal can be a key for market participants to unlock this opportunity.

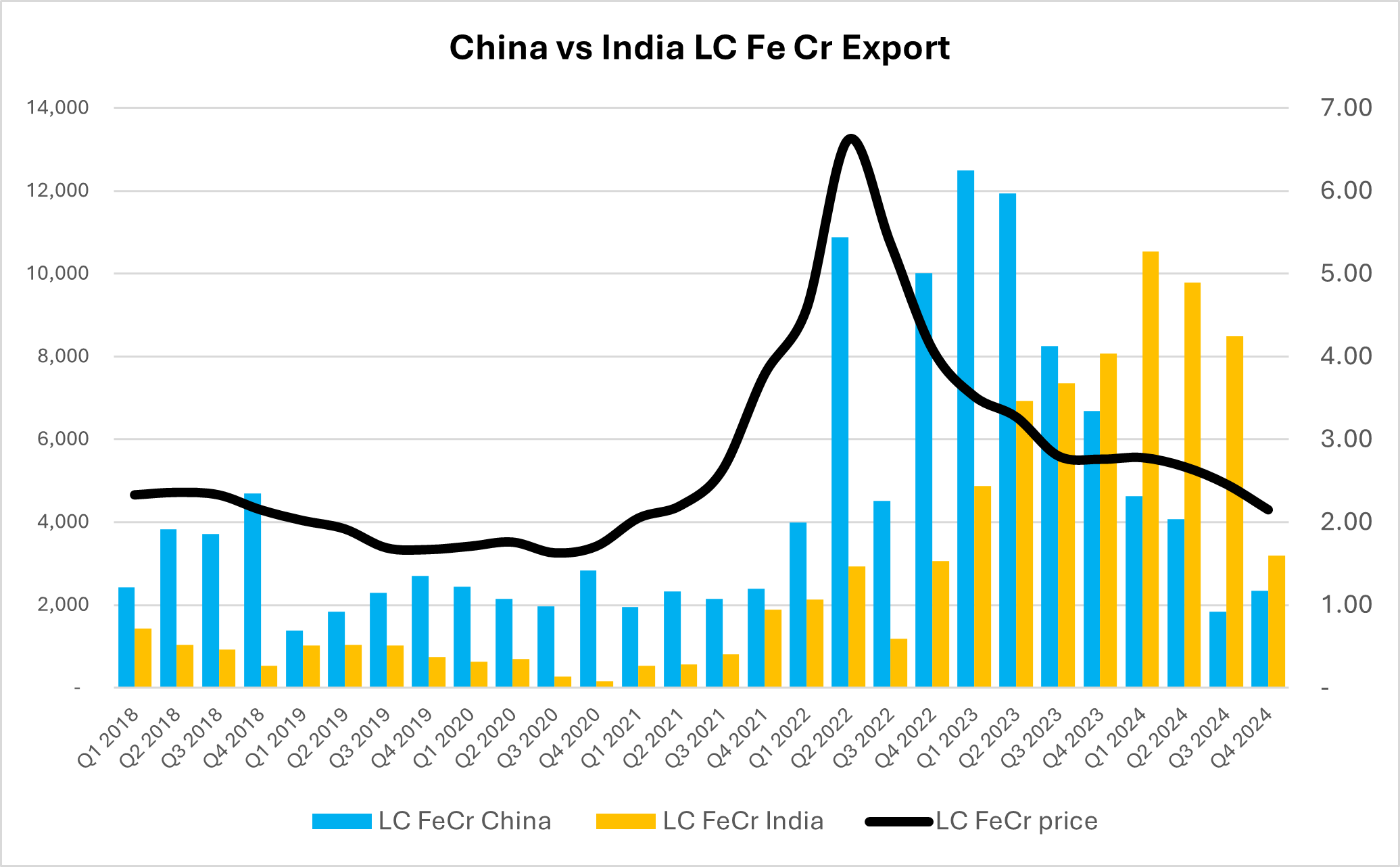

One of the examples of arbitrage opportunity is export of refined FeCr from China and India in 2022-2024 (as illustrated by the graph below):

· When prices peaked in H2 2022, producers in China started shipping material to Europe and USA, where prices were high enough to offset 40% export duty. Once the price correction started, shipment of material from China started to decrease rapidly now are just a fraction of the seaborne market for refined FeCr.

· India started to ramp up its export of LC/MC FeCr a bit later than China, but since there is no export duty and smaller logistics costs, producer in India had an arbitrage opportunity to sell material ex-India. As the prices continued to decrease, so did the export volumes. And while they still are significantly higher than volumes from China, the overall trend points to continues decrease.

With the recent steep drop in domestic prices in China for HC FeCr, and prices ex-China steading at much higher level a new arbitrage opportunity could present itself for export of material from China

One of the main reasons why arbitrage opportunity for producers in China and India started to decrease is limited price discovery, that takes time to adjust to new supply/demand conditions, as the result by the time some of the cargoes arrive to the destination, it becomes uneconomical to sell them.

What allows SoftMetal to counter the above-mentioned issues:

· All the material traded on SoftMetal is already located in the warehouses, thus eliminating the need to wait for its arrival

· Participants can see non-stop live stop market, and estimate where the market is heading, based on prices for concluded deals

· Users can define their own price indicators, especially for material that doesn’t have an index, for example MC FeCr

· The deals are concluded within 24 hours

All that allows SoftMetal clients to trade material conveniently, securely and fast. As a result, market fluctuations could allow the possibility of arbitrage opportunity.

Another example of how arbitrage opportunity could’ve been achieved with SoftMetal is recent price spike in spot prices for HC FeCr in China. Before National holiday in China, prices hovered around 7000 RMB/t, but after the holidays, prices increased rapidly to 7600 RMB/t. An increase of around 9% within just a few weeks. With SoftMetal users could have placed their sales offers already at a higher level (for material that was purchased during the downturn), in anticipation of market improvement. Thus, making a very good profit.